Sensory Performance for Coffee Roasters with IKAWA

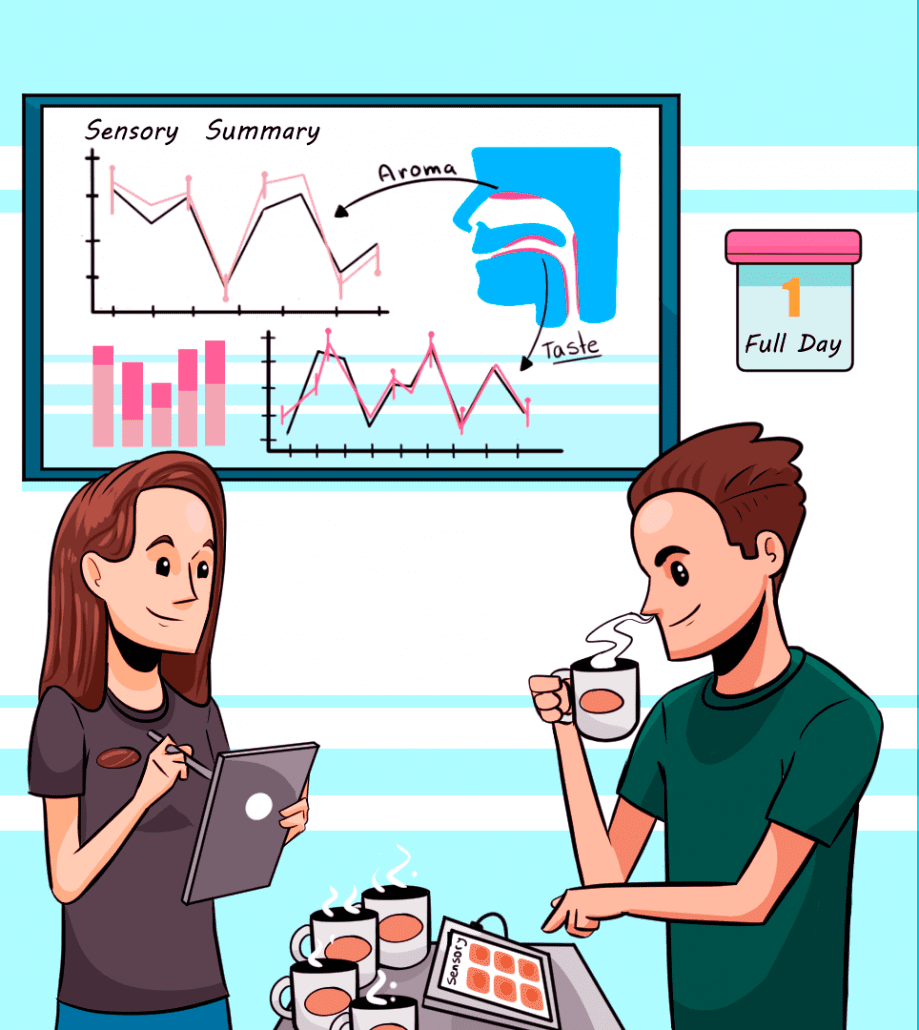

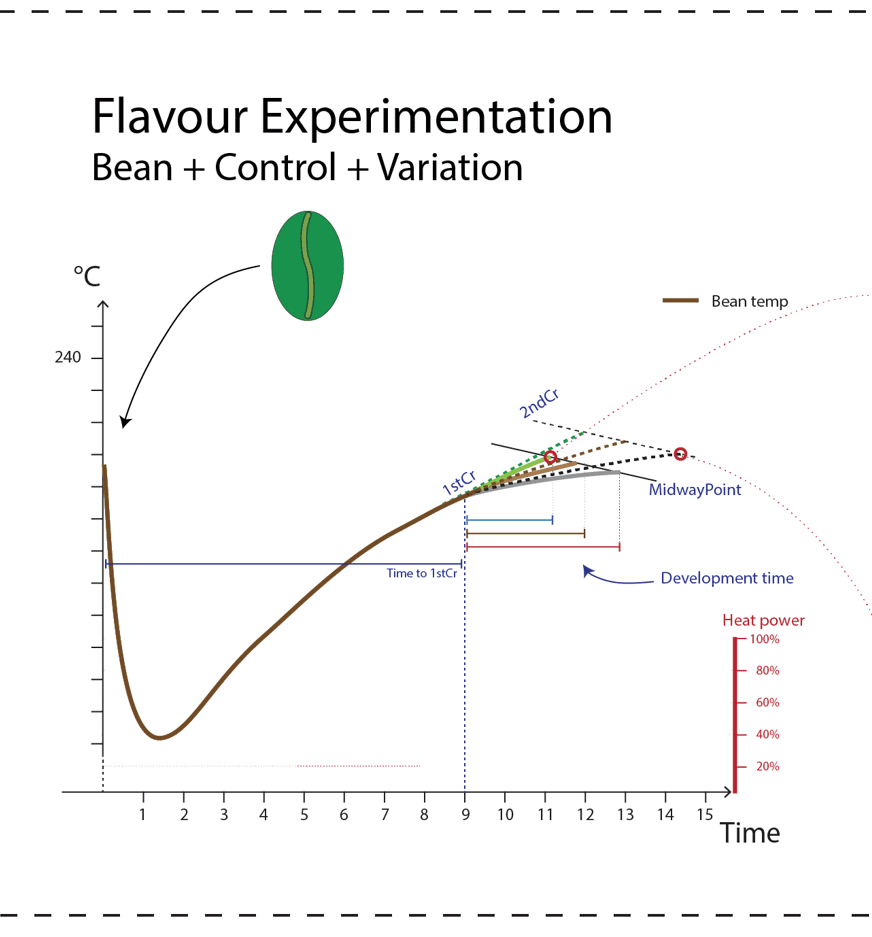

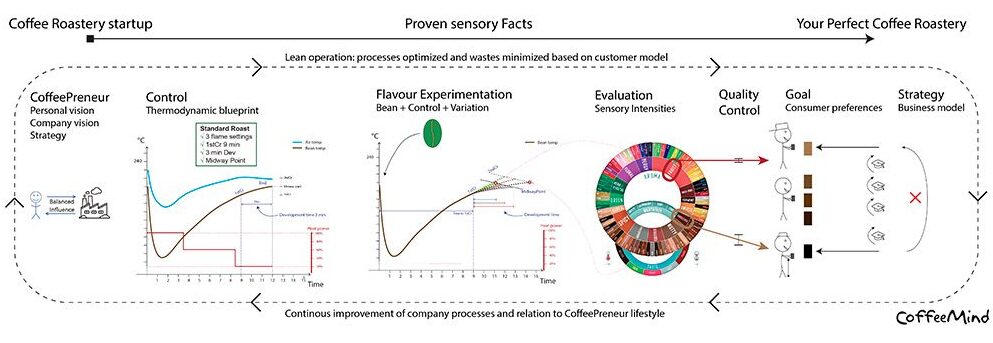

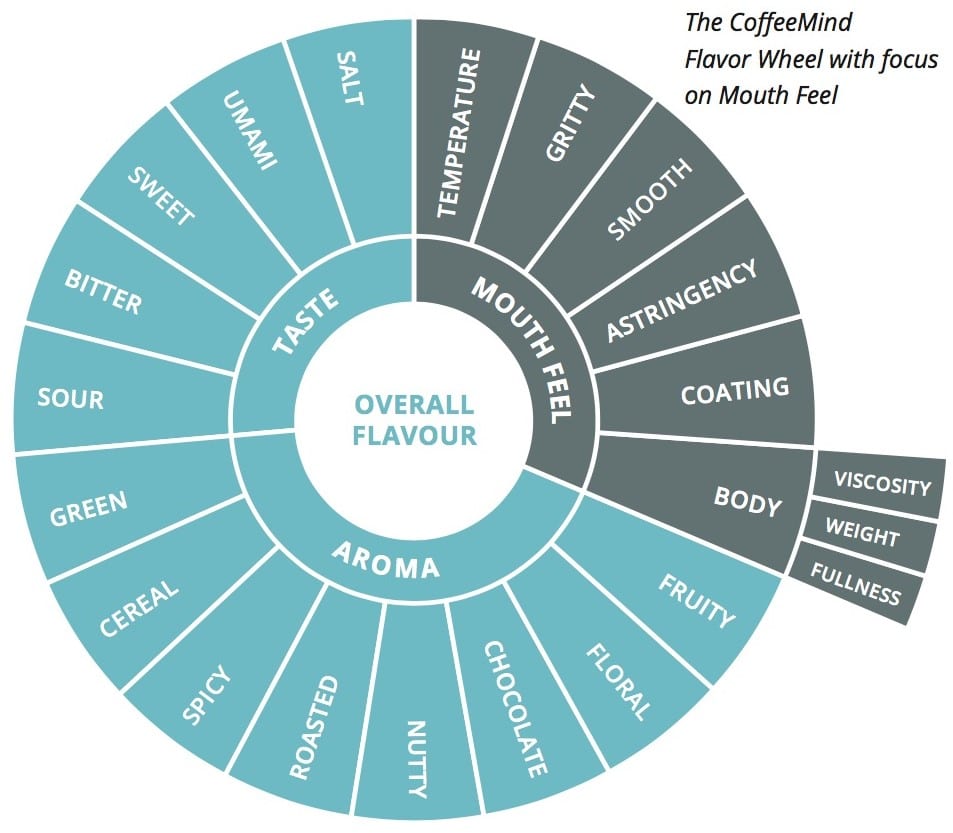

Unlocking New Heights in Coffee Sensory Training In recent years, the field of sensory science has advanced dramatically, offering systematic, data-driven methods to evaluate and improve our ability to perceive coffee flavours. At CoffeeMind, we have harnessed these scientific advances into custom statistical software that integrates the latest genres of sensory testing—from discriminative to descriptive […]

Sensory Performance for Coffee Roasters with IKAWA Read More »